► European stocks saw an increase on Monday with the Stoxx 600 seeing a 0.6% increase. We also saw the earnings report of Europe's largest bank, HSBC. HSBC's Q3 profits soared to $6.26 billion, marking a 235% increase from the previous year, but fell short of analysts' expectations. The spike was influenced by a higher interest rate environment and a $2.3 billion impairment from its planned French retail banking sale in 2022.

► Markets in Europe also react on data coming out of Germany, specifically the GDP Growth rate and CPI data. Germany's economy shrank a bit less than expected -0.1% MoM and -0.3% YoY (vs -0.7% expected). Expectations are for YoY inflation to go down to 4% from last month's 4.5%. Unless data surprises dramatically, expectations should remain high for the ECB to be done with hikes.

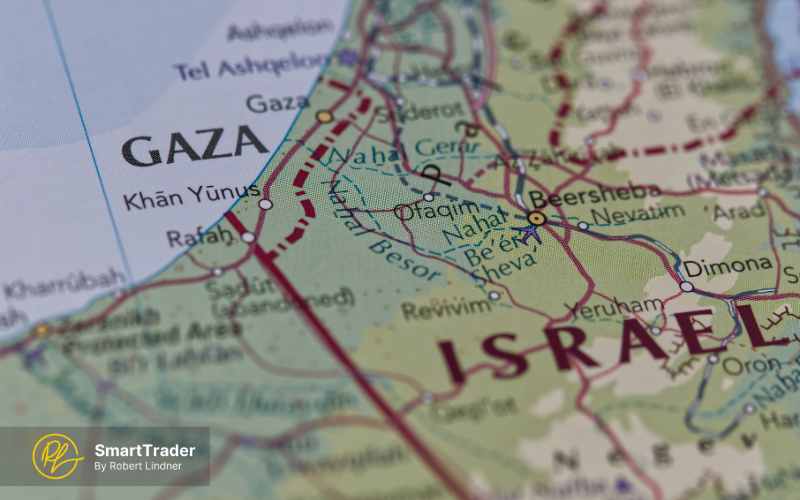

► US equity markets look back on another difficult week as the major indexes were mostly in the red due to a mix of mixed corporate earnings, economic indicators and ongoing geopolitical tensions. However, Monday looks a bit brighter with futures indicating an upward momentum with the S&P 500 trading currently 0.65% higher. We also see earnings season continue with earning reports from companies like Apple, Eli Lilly, Novo Nordisk, McDonald's, Pfizer, and AMD this week.

Subscribe to see more