📆 Wednesday, May 7

► European markets were unable to keep overnight gains with investors remaining skeptical about the outlook for trade deals and remain cautious ahead of the Federal Reserve’s policy decision. The Stoxx 600 dipped over 0.3%, led lower by retailers and healthcare stocks despite strength in autos. Novo Nordisk rallied nearly 6% after beating Q1 profit expectations, though the broader market remained cautious. PMI data for the construction industry in the Eurozone rose slightly, but French trade data disappointed and political uncertainties, including the shaky start of the new German government, continued to weigh on sentiment.

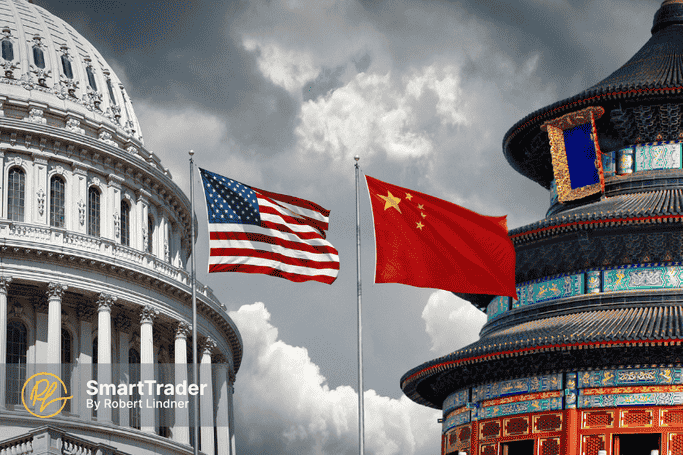

► US equity futures advanced as planned trade talks between the US and China lifted hopes of easing tensions. S&P 500 and Nasdaq 100 futures are trading about 0.6% higher potentially snapping a two-day losing streak. Investors welcomed confirmation that senior US and Chinese officials would meet in Switzerland this weekend to discuss de-escalation of tariffs. However, much of the initial overnight gains have already been lost as investors focus on today's decision by the Federal Reserve. The markets are not expecting a change in interest rates, as policymakers are likely to adopt a wait-and-see attitude in view of the robust US data and ongoing trade uncertainty.

► Asian markets mostly gained, supported by China’s monetary policy easing and optimism over renewed US-China trade negotiations. The Shanghai Composite climbed 0.8% while Hong Kong’s Hang Seng rose modestly (+0.13%), boosted by Beijing’s decision to cut key lending rates (by 10 bps) and lower banks’ reserve requirements. The offshore CNY weakened despite stimulus measures, while regional currencies mostly stabilized after recent volatility driven by trade and Fed policy expectations. Japan’s Nikkei declined 0.2%, while Australia’s ASX 200 added 0.33%. Markets were little affected by India's military strikes against Pakistan as tensions spiral after Kashmir killings.

Subscribe to see more