📅 Thursday, July 17

► Europe rallies on easing political jitters; banks & tech lead gains

European stocks outperformed, with the Stoxx 600 up +065%, led by banks and tech names. Germany’s DAX rose +0.75%, CAC 40 +0.85%, and FTSE +0.50%. Bond yields were stable across the region. Despite Trump's tariff threats last week, markets appear increasingly immune to headline risk, instead focusing on earnings and macro data. EUR/USD dropped back below 1.16000 as predicted by SmartTrader's chief analyst Robert Lindner (currently at 1.15850 or -0.45%) amid broad USD strength.

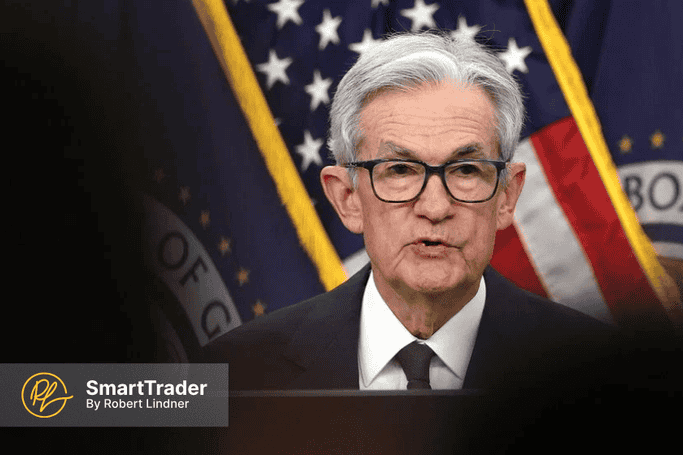

► US dollar rebounds as Powell fears ease; AI-related stocks, banks keep indices positive

Markets stabilized Thursday as President Trump walked back threats to fire Fed Chair Jerome Powell. The dollar regained strength (DXY +0.4%) and long-end Treasury yields edged higher, with 10Y at 4.42%. Equities opened steady after Taiwan Semiconductor lifted its 2025 revenue outlook, reinforcing the AI bull case. Nasdaq 100 futures rose +0.1%, while S&P 500 was flat. JPMorgan, Goldman, and others reported strong H1 trading revenues, supporting a solid start to the earnings season. Trump also softened his tone on China, suggesting efforts to resume summit talks — another reason risk sentiment held up.

► Asia broadly positive; Nikkei leads, India underperforms

Asia-Pacific markets ended mostly higher as headline noise from the US faded. Japan’s Nikkei gained +0.6% and South Korea’s Kospi added +0.19%. China’s CSI 300 climbed +0.68% while the Hang Seng closed flat. Australia’s ASX 200 rose +0.9%. India was an outlier with the Nifty 50 falling -0.4%, dragged by profit-taking and weaker tech sentiment. USD/JPY jumped to 148.7 (+0.6%) as traders scaled back rate cut bets globally. AUD/USD weakened (-1%) after soft jobs data reinforced RBA dovishness.

Subscribe to see more