📅 Tuesday, July 22

► Europe dips on earnings jitters & concerns about US tariffs deadline

The Stoxx 600 fell nearly -0.6%, as earnings failed to lift sentiment. Coca-Cola beat estimates but dropped -0.9%, citing volume declines. General Motors beat too, yet shares fell -2% as CFO flagged a $1.1B tariff hit in Q2 – while US stocks – it shows that investors are cautious in expanding their long positions. Broader losses were seen across Europe (DAX -1.1%, CAC -0.75%, FTSE 100 -0.1%, -FTSE MIB -0.15%), while EUR/USD slipped slightly (-0.1%) to 1.169. AstraZeneca announced a massive $50B US investment ahead of potential pharma tariffs. European stocks are struggling to price in the tariff path and macro drag, with multiple firms guiding cautiously despite solid topline numbers.

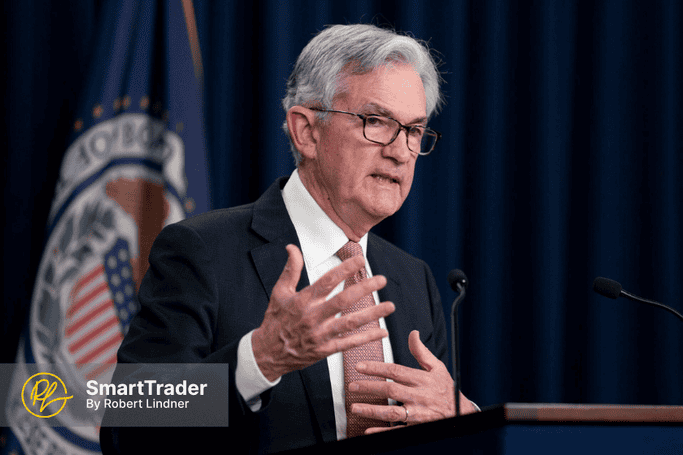

► US futures flat as tariff worries and Fed anticipation temper momentum

Markets paused after a strong run, with S&P 500 futures flat and Nasdaq 100 down -0.2%, as investors await Fed Chair Jerome Powell’s speech and key earnings from Tesla and Alphabet tomorrow. The S&P 500, still near all-time highs, hasn’t seen a 1% move since late June — a sign of unusual calm amid growing uncertainty. With stretched valuations (S&P trading at 22x forward EPS), traders are watching closely for guidance on the tariff fallout and Fed policy. The 10Y yield was steady, and the USD held flat. White House officials warned that more unilateral tariff letters may follow in the coming days.

► Asia mixed as China rallies, Korea lags; Japan edges lower post-election

Asia-Pacific markets ended mixed, with China leading gains: CSI 300 rose +0.82%, Shenzhen +0.84%, and Hang Seng +0.54% on steel reform hopes and dam project headlines. Japan’s Nikkei fell -0.11% after early gains faded, while Korea’s Kospi dropped -1.27% amid tech weakness. India was mostly flat. FX markets remained rangebound: USD/JPY (-0.2%) at 147.19, and AUD/USD (-0.05%) little changed at 0.652. Local sentiment remains tethered to global macro moves, as traders brace for Powell and the week’s big earnings.

Subscribe to see more