🗓 Monday, September 22, 2025

► Europe firmer – PMI services lift sentiment

European equities started higher, supported by improving PMI data in services while manufacturing weakness persisted. Stoxx 600 +0.40%, DAX +0.35%, CAC 40 +0.8%, FTSE 100 +0.1%, FTSE MIB +0.25%, IBEX +0.5%. Bund 10Y 2.74% (flat), UK 10Y 4.67% (-5bps). EUR/USD 1.179 (-0.1%), GBP/USD 1.351 (flat), USD/JPY 147.8 (+0.1%). Traders noted particularly weak German & UK manufacturing prints, but better-than-expected services PMIs kept sentiment intact.

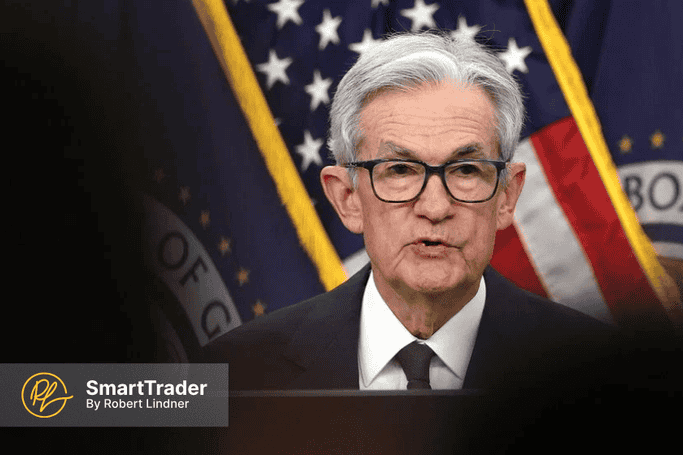

► Wall Street futures muted – Powell ahead

US futures traded indecisively after last recent record highs and Nvidia’s $100B OpenAI pledge. Nasdaq 100 futures +0.05%, S&P 500 flat, Dow +0.15%. Treasuries steady, 10Y yield 4.13% (-1.5bps). Gold’s surge was making headlines after reports of increased Chinese central bank purchases. Traders await Powell’s speech later today for clarity on the Fed’s path, while Friday’s core PCE data remains the key macro event. Implied volatility stays low despite concerns over elevated valuations and looming government shutdown risks.

► Asia mixed – Japan leads, China lags

Asian equities ended mixed. Nikkei +1.0% led gains, supported by tech and exporters. Kospi +0.5%, Taiwan +1.4%, ASX +0.4%. Shanghai -0.2%, Shenzhen -0.3%, Hang Seng -0.7%. USD/JPY 147.8 (+0.1%) steady after last week’s BoJ hold and ETF sales plan. Sentiment in China remained cautious amid ongoing property sector stress and outflows.

Subscribe to see more