🗓 Thursday, October 9, 2025

► Europe mixed – earnings season focus, Middle East truce supports risk

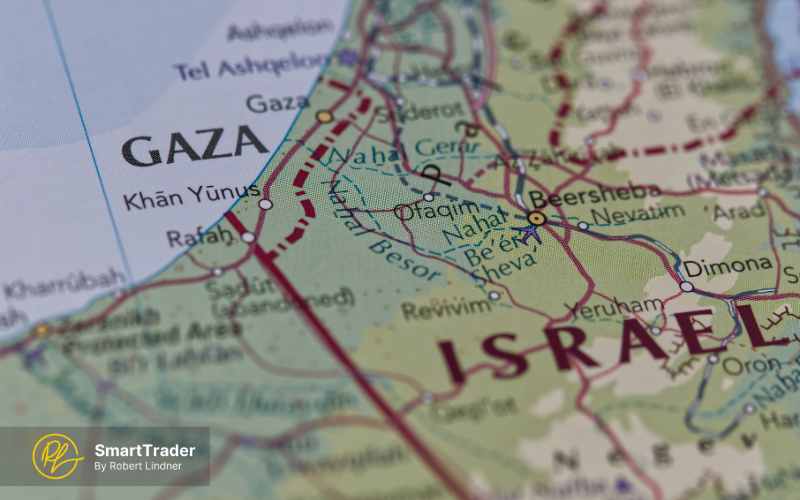

European equities hovered near record levels, supported by easing geopolitical tensions after reports of a ceasefire between Israel and Hamas, while investors shifted focus to the start of Q3 earnings season. Stoxx 600 flat, DAX +0.7%, CAC 40 +0.6%, FTSE 100 -0.2%, FTSE MIB -1.0%, IBEX -0.25%. Bund 10Y 2.69% (+1bp), UK 10Y 4.73% (+1bp). EUR/USD 1.161 (-0.1%), GBP/USD 1.338 (-0.2%), USD/JPY 152.8 (+0.1%). Sentiment was resilient despite valuation concerns, as earnings from PepsiCo and Delta Air Lines beat expectations, signaling robust fundamentals. European bank stocks lagged after Lloyds and HSBC warnings, but broader risk appetite improved on hopes for easing geopolitical risks.

► Wall Street futures steady – investors eye earnings validation

US futures held near record highs following Wednesday’s rally, with S&P 500 flat, Nasdaq 100 flat, Dow flat. Traders looked ahead to Q3 results to justify lofty valuations after a $16T market run since April. Delta +5% and PepsiCo +1% boosted sentiment, while Nvidia rose after US approval for chip exports to the UAE. US 10Y 4.13% (flat). Analysts expect potential short-term volatility but Robert Lindner, SmartTrader chief analyst remains confident that strong earnings and the Fed’s rate-cut path will continue support equities.

► Asia higher – China and Japan lead rebound

Asian markets closed broadly higher, tracking Wall Street gains and supported by improving sentiment around AI and easing geopolitical risks. Nikkei +1.8%, Taiwan +0.9%, Shanghai +1.3%, Shenzhen +1.5%, Kospi +2.7%, ASX +0.25%, Hang Seng -0.3%. USD/JPY 152.8 (+0.1%). Tech optimism and stimulus hopes in China underpinned regional gains, with chipmakers and industrials leading advances.

Subscribe to see more