🗓 Tuesday, August 19, 2025

► Europe firmer as peace hopes lift sentiment; defense stocks lag

European equities moved higher, with the Stoxx 600 +0.5%, the DAX +0.2%, CAC 40 +0.8%, and the FTSE 100 +0.35%. Italy’s FTSE MIB outperformed at +0.7%, while the IBEX gained +0.4%. Optimism followed Trump–Zelenskyy talks with European leaders, which investors viewed as a potential first step toward peace. However, defense names sold off: Rheinmetall -7%, Leonardo -6.9%, Hensoldt -6.3% due to lower demand expectations if negotiations advance. Bond yields eased modestly: Bund 10Y at 2.76% (-1.5bps). EUR/USD edged up to 1.168 (+0.2%), GBP/USD at 1.352 (+0.1%), and EUR/JPY stable at 172.6.

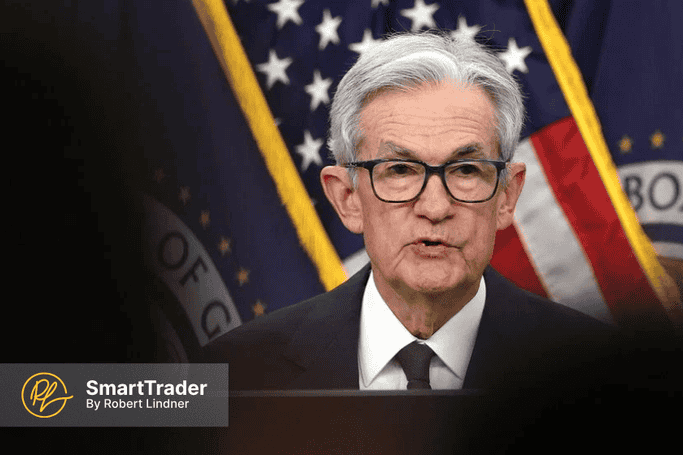

► Wall Street cautious as retail earnings roll in; Jackson Hole looms

US futures are little changed (S&P 500 flat, Nasdaq -0.1%, Dow +0.15%), as investors balanced retail earnings with upcoming Fed guidance. Home Depot fell early after a sales miss but rebounded to trade +1% on reaffirmed fiscal 2025 guidance. Earnings from Lowe’s, TJX, Target, and Walmart later this week will give further insight into consumer resilience. Intel surged +6% premarket after reports of Trump administration talks over a potential stake, while SoftBank confirmed a $2bn investment in the chipmaker. Palo Alto Networks jumped +5% after a strong beat and upbeat outlook. Treasuries firmed: US 10Y yield at 4.32% (-1bp). Markets await Powell’s speech at Jackson Hole, with expectations of a 25bp September cut (~83% odds, CME FedWatch).

► Asia mixed as China steadies; Japan slips from record

Asian markets were mixed. China’s Shanghai Composite -0.02% to 3,727 and Shenzhen -0.12% to 11,822, while Hong Kong’s Hang Seng eased -0.21% to 25,123. Japan’s Nikkei retreated -0.38% to 43,546 after hitting record highs Monday, while Korea’s Kospi fell -0.8% to 3,152. Weakness also showed in Australia’s ASX 200 -0.7% and Taiwan -0.5%. India’s Nifty 50 gained +0.4% to 24,981, and Singapore’s STI rose +0.7% to 4,216. FX stable: USD/JPY 147.7 (-0.1%), USD/CNY 7.179 (-0.08%), AUD/USD 0.649.

Subscribe to see more