🗓 Friday, August 22, 2025

► Europe higher – tech sell-off pauses, German GDP disappoints

European equities opened firm and extended gains through the morning as defensive sectors and value plays outperformed. Sentiment was helped by a pause in the tech sell-off, though weaker-than-expected German GDP numbers weighed on confidence (QoQ -0.3% vs. -0.1% expected; YoY +0.2% vs. +0.4%). Still, investors looked past the data, focusing on Powell’s Jackson Hole speech later today for direction. The Stoxx 600 +0.3%, DAX +0.1%, CAC 40 +0.2%, FTSE 100 +0.0%, FTSE MIB +0.6%, IBEX +0.4%. UK gilts saw some selling, with 10Y yields up to 4.75%, while Bunds held steady at 2.74%. EUR/USD 1.159 (-0.1%), GBP/USD 1.341, EUR/JPY 172.4.

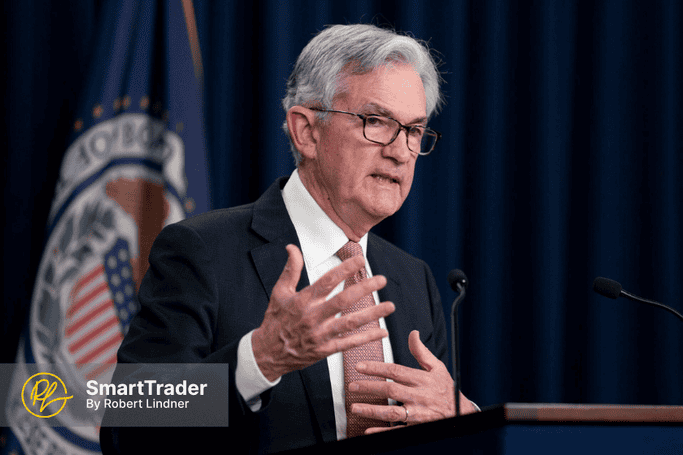

► Wall Street futures slightly higher; Powell speech at 14:00 UTC+0 (10:00 NY time / 15:00 London time)

US index futures turned positive after a difficult week as investors awaited Powell’s keynote, with expectations now dialed back for aggressive rate cuts. The focus is on whether the Fed signals more willingness to start cutting rates and how it acknowledges sticky inflation versus slowing growth. Alphabet led gains among the Magnificent Seven, up more than 1%, while Nvidia lagged after reports of production halts for a key AI chip. Futures: S&P 500 +0.25%, Nasdaq +0.2%, Dow +0.4%. The 10Y Treasury yield held at 4.34% after rising sharply earlier in the week. Analysts including SmartTrader's Robert Lindner say any hawkish tilt could reignite selling, while a dovish tone might fuel a relief rally.

► Asia mixed – China strong, Japan flat, Australia dips

Asian markets showed a split performance with solid gains in China contrasting softer moves elsewhere. Shanghai +1.5% and Shenzhen +2.1% surged on local stimulus hopes, while Hong Kong’s Hang Seng +0.9% recovered some lost ground. Japan’s Nikkei was barely positive +0.1% and Australia’s ASX 200 pulled back -0.6% after hitting record highs earlier this week. Korea’s Kospi +0.9%, Singapore’s STI +0.5%, India’s Nifty -0.9%, Taiwan -0.8%. FX stayed calm: USD/JPY 148.65, USD/CNY 7.179, AUD/USD 0.642.

Subscribe to see more