📆 Tuesday, January 21

► European stocks wavered, with the Stoxx 600 trading flat as investors assessed the impact of potential tariffs under Trump. Automakers fell nearly 1%, as fears of higher tariffs on Mexico and Canada raised concerns over global supply chains. Renewable energy stocks slumped, with Vestas (-5%) and Orsted (-17%) plunging after Trump ordered a freeze on offshore wind projects. Orsted also announced a $1.7B impairment on its US projects, further weighing on sentiment. The EUR (-0.5%) and GBP (-0.7%) weakened vs the USD (AUD even -0.9%), with traders pricing in potential retaliatory tariffs from the US on European goods in the future. Germany’s ZEW economic sentiment index came in much worse than expected showing poor sentiment for the German economy among analysts. Economic sentiment for the Eurozone on the other hand came in better than expected.

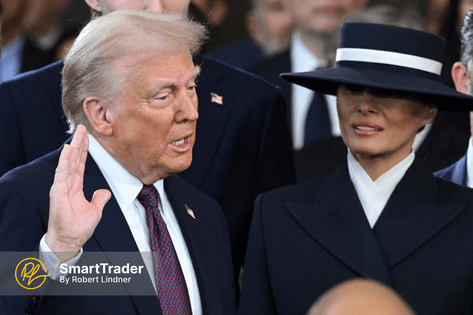

► US stock futures are slightly up (around +0.3%) showing the movements that our chief analyst predicted (pressure on markets outside of the US and capital inflow to Wall Street) as traders processed Trump’s trade threats and their potential inflationary impact. The DXY surged (+0.55%), reversing its earlier losses after Trump threatened 25% tariffs on Canadian and Mexican imports. The CAD (-1.4%) and MXN (-1.4%) tumbled sharply, reaching multi-month lows. Treasury yields fell (by about 3 bps), with the 10-year yield to 4.58%, as investors reassessed inflation risks following Trump’s comments. Bond traders remain divided some expect Fed rate cuts, while others now see even a potential rate hike if tariffs drive inflation higher. SmartTrader chief analyst Robert Lindner expect rates to remain at current levels for longer and likely no rate cut in H1. In corporate news, Q4 earnings season continues, with Netflix, 3M (already reported), and United Airlines set to report today. Investors are also closely watching the World Economic Forum in Davos, where CEOs and policymakers will discuss global economic trends.

Subscribe to see more