📆 Friday, March 21

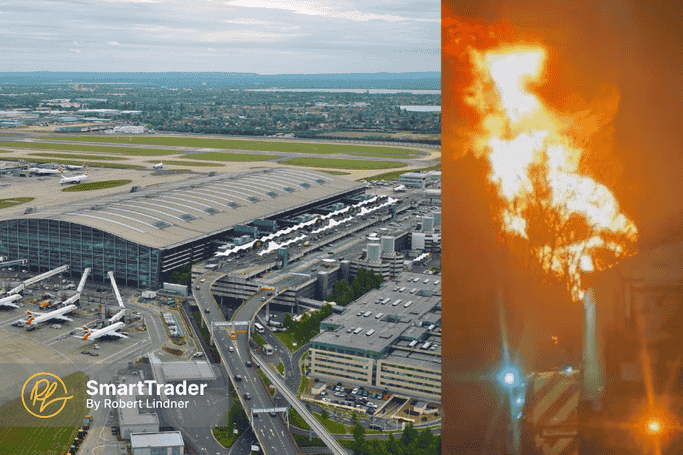

► European markets were in the red on Friday as global growth concerns and fresh trade tensions weighed on sentiment. The Stoxx 600 fell 0.6%, dragged down by travel & leisure stocks (-2.1%) following a fire that shut down Heathrow Airport – Europe's busiest airport – halting flights and sending IAG shares down over 3%. We also saw Germany's DAX (-0.6%), France’s CAC 40 (-0.65%), and UK’s FTSE 100 (-0.4%) down as well however stabilizing. Investors digested muted central bank decisions and awaited Germany’s upper house vote on its €500B+ infrastructure stimulus. Bond markets reflected the cautious mood, with Germany’s 10Y yield slipping to 2.77%. The EU delayed planned whiskey tariffs, hoping to re-engage Trump in trade talks ahead of his April 2 tariff rollout.

► US futures edged lower, with S&P 500 futures down 0.5%, pressured by disappointing earnings from FedEx (cutting profit outlook) and Nike (citing tariffs and geopolitics). Markets braced for triple witching, with $4.5 trillion in options contracts expiring, likely driving volatility. The Nasdaq 100 fell 0.3%, led lower by (no surprise!) Tesla (-1%) and chip weakness, despite a rebound in Nvidia after bullish AI updates and a strong earnings report + forecast from Micron. Fed Chair Powell’s reassurance that inflation from tariffs may be transitory helped stabilize sentiment mid-week, but investor caution remains ahead of April’s key policy pivot. The US 10Y Treasury yield declined to 4.23%, while the USD extended gains for a third day as safe-haven demand returned.

► Asian markets stumbled, with Hong Kong’s Hang Seng Index tumbling 2.19%, led by a sharp 3.4% drop in tech as recent gains were unwound. China’s CSI 300 dropped for a third straight day (-1.15%), pressured by weak sentiment and a softer CNY, now trading past 7.25/USD. Japan’s Nikkei 225 declined 0.5% in post-holiday trade, as core inflation came in hotter than expected (3%), raising expectations of further BOJ hikes. India’s Sensex (+0.7%) extended its winning streak to five sessions, while Australia’s ASX 200 inched up 0.17%, led by retailers. Across the region, traders eyed Trump’s looming tariff deadline, adding to the nervous tone heading into the weekend.

Subscribe to see more