🗓 Tuesday, December 9, 2025

► Europe flat to softer – markets cautious with little trading volume before Fed

European equities oscillated around the flatline as investors avoided big positioning ahead of tomorrow’s Fed decision. Stoxx 600 -0.16%, DAX +0.28%, CAC 40 -0.56%, FTSE 100 -0.10%, FTSE MIB +0.16%, IBEX 35 -0.06%, SMI -0.46%. Sector moves were stock-specific: EssilorLuxottica -4.8% slid after Google unveiled its own AI-powered glasses for 2026, while EU wind and utilities names saw a modest bid after a US court overturned Trump’s offshore wind ban. Sentiment was also shaped by a new EU deal to “simplify” corporate sustainability rules, easing reporting burdens for many companies. EUR/USD 1.164 (flat), GBP/USD 1.331 (-0.05%), EUR/GBP 0.874 (+0.1%).

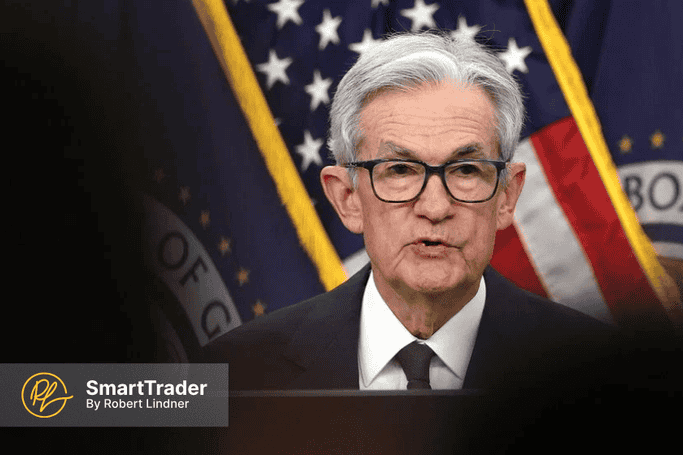

► Wall Street cautious – sideways trade as “hawkish cut” risk looms; JOLTS in focus

US futures were little changed as traders waited for Wednesday’s Fed decision and Powell’s press conference. S&P 500 futures (-0.05%), Nasdaq 100 futures (-0.2%), Dow futures flat. Swap and futures markets still price an ~87–89% chance of a 25 bps cut tomorrow, but now see less than two additional cuts through 2026 – raising the risk of a “hawkish cut” message that stresses caution about easing too fast. The 10Y yield stills hovers near a two-month high around 4.15% as global bond markets stay under pressure, with RBA and ECB officials signaling their own easing cycles are soon over and the BoJ expected to hike next week. Nvidia + premarket ticked higher after Trump approved H200 AI chip shipments to “approved” Chinese customers in exchange for a 25% revenue cut to the US government; Oracle, Broadcom and other AI names remain in focus ahead of earnings. JOLTS job openings – the last key labor datapoint before the Fed – are expected to show a modest cooling after recent mixed ADP and payrolls signals.

► Asia mixed – China & Korea softer; Japan steady; Fed and global bonds cap risk appetite

Asian markets delivered a mixed session, reflecting caution ahead of the Fed and ongoing pressure in global bonds. Nikkei +0.14%, Kospi -0.27%, Taiwan -0.43%, HSI -1.29%, Shanghai -0.37%, Shenzhen -0.40%, Nifty -0.47%, ASX 200 -0.45%. Mainland China and Hong Kong lagged as profit-taking hit recent tech and growth winners, while SGX China Growth -1.65% highlighted renewed skepticism around China’s medium-term momentum despite domestic-demand pledges. Japan held up better despite GDP worries and BoJ uncertainty, with investors still expecting only gradual hikes from Tokyo. Overall, the region stayed broadly risk-on but with reduced conviction as traders await clarity on the Fed’s 2026 path.

Subscribe to see more