📆 Thursday, March 20

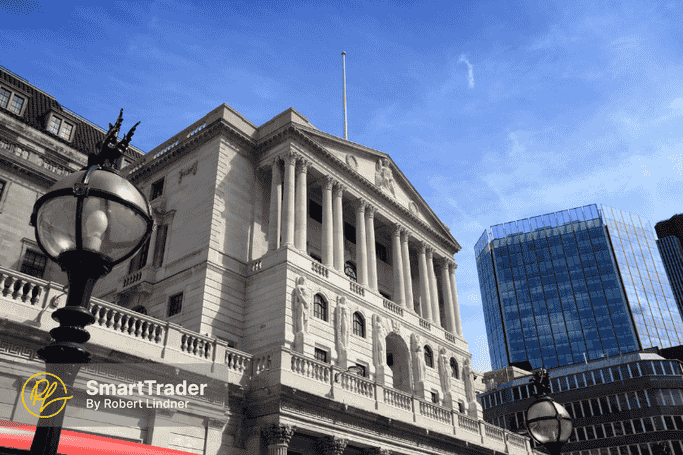

► European markets are trading lower as investors digested fresh economic data and awaited multiple central bank decisions. The Stoxx 600 declined 0.7%, while Germany’s DAX dropped over 1.4%, despite a slower-than-expected rise in producer prices. The BOE is kept rates unchanged, but signaled a “gradual and careful” approach to policy easing in the face of global turbulence and sticky inflation. Elsewhere, Norway’s $1.8 trillion sovereign wealth fund announced new investments in European real estate, signaling confidence in the region’s economic outlook. In corporate news, German shipping giant Hapag-Lloyd (- 8.9%) reported a 19% drop in annual profits, citing challenging market conditions, while bond yields across Europe ticked lower as expectations for future rate cuts remained intact.

► US stock futures are slightly lower, with the S&P 500 down 0.25% and Nasdaq 100 currently trading 0.3% lower. The Federal Reserve reassured investors that tariff-driven inflation will likely be transitory. Fed Chair Jerome Powell struck a cautiously dovish tone, stating that while Trump’s trade policies introduce uncertainty, they do not warrant an immediate shift in monetary policy. The Fed held interest rates steady at 4.25%-4.50%, but maintained its outlook for two rate cuts later this year, while downgrading GDP growth forecasts and slightly raising inflation projections. In corporate news, Nvidia surged pre-market after reports that the company plans to spend hundreds of billions of dollars on US-made chips and electronics over the next four years. Meanwhile, Trump reiterated calls for the Fed to cut rates, arguing that tariffs will soon “ease” into the economy and should not be viewed as long-term inflationary. Investors are now eyeing jobless claims data and earnings reports from Nike, FedEx, and Micron for further market direction.

► Asian markets were mostly lower as investors reacted to the Fed’s decision and fresh economic data out of China. Japan’s Nikkei remained closed for a holiday, while China’s CSI 300 fell, snapping a three-day winning streak as investors took profits in technology stocks. The Shenzhen Component also dropped 0.9%, reflecting concerns over China’s youth unemployment rate, which rose to 16.9% in February, up from 16.1% in January. In Hong Kong, the Hang Seng Index slumped 2.23%, ending a two-session winning streak, as weakness in tech stocks weighed on sentiment. Meanwhile, India’s Sensex climbed 0.62%, led by gains in media, tech, and auto stocks. In Australia, the ASX 200 surged 1.16%, rebounding from prior losses, though the AUD continued to weaken as traders reassessed the Reserve Bank of Australia’s monetary policy stance following weaker-than-expected jobs data.

Subscribe to see more